Case Study - Is Retail Stepping Back From $BBAI?

Stocktwits Edge offers real-time social sentiment access so you can catch the next move. Spot when sentiment turns bullish or bearish, track message volume and watchlist activity, and stay one step ahead.

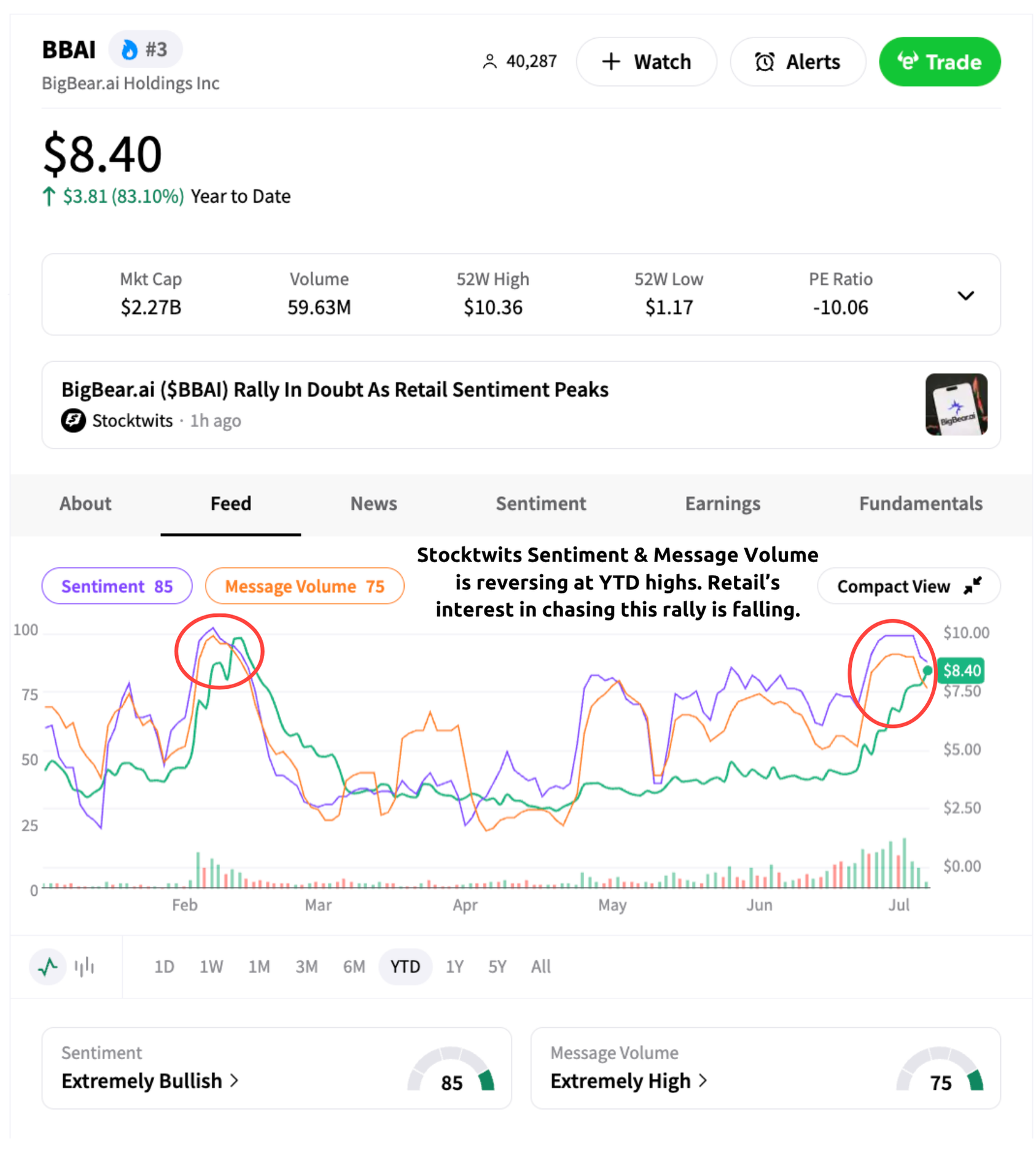

$BBAI Case Study: A rally with fading sentiment

BigBear.

Last week, Stocktwits Sentiment and Message Volume hit year-to-date highs — but both have since pulled back, even as price stays flat. That could indicate retail enthusiasm is cooling at current levels.

From a technical perspective, RSI is also nearing overbought territory, which has often coincided with short-term tops in $BBAI over the last two years.

Retail might still love the long-term story, but they may be waiting for better prices before jumping back in.

Add $BBAI to your watchlist to monitor the setup. More importantly, to catch signals like this in real time — unlock full sentiment data with Stocktwits Edge.

Disclaimer: This real-time Stocktwits Sentiment use-case example was curated by Stocktwits’ Editor-in-Chief, Tom Bruni, and is solely for informational and educational purposes. Tom does not hold any positions in BigBear.